Bitcoin Halving Explained: A Beginner’s Guide to Understanding the Basics

Navigating the Impact of Bitcoin Halving 2024 and Beyond

In the realm of cryptocurrency, few events hold as much significance as the Bitcoin halving. It’s an occurrence that affects not only Bitcoin miners but also investors and enthusiasts alike. If you’re new to the world of Bitcoin or just starting to explore its intricacies, understanding what Bitcoin halving entails is crucial. In this beginner’s guide, we’ll break down the fundamentals of Bitcoin halving, its history, and its implications for the future.

What is Bitcoin Halving?

Bitcoin halving refers to the process by which the rewards for mining new blocks on the Bitcoin blockchain are reduced by half. This event occurs approximately every four years or after every 210,000 blocks mined. The purpose behind halving is to control the issuance of new Bitcoins, thereby maintaining a finite supply and curbing inflation.

Bitcoin Halving History

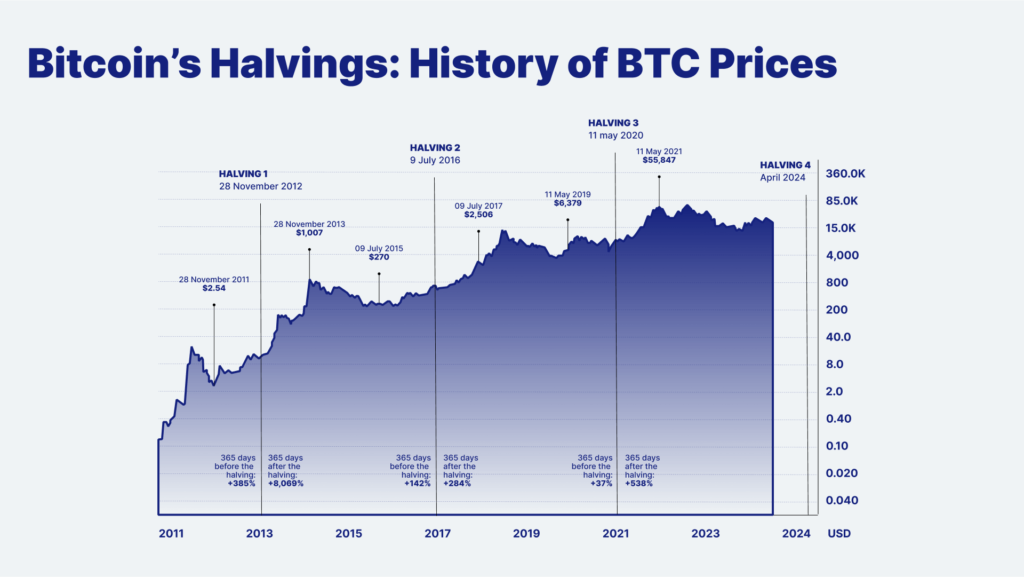

Since its inception in 2009, Bitcoin has undergone two halving events before 2024, each time reducing the block reward by half. The first halving took place in November 2012, reducing the block reward from 50 BTC to 25 BTC. The second halving occurred in July 2016, further reducing the reward to 12.5 BTC per block. These events have historically sparked significant interest and volatility in the cryptocurrency market.

Bitcoin Halving 2024: What to Expect

As of 2024, Bitcoin is gearing up for its third halving event, scheduled to take place later this year. The exact date can be predicted based on the Bitcoin halving clock, counting down the blocks until the next halving. This anticipation often leads to speculation and price fluctuations in the months leading up to the event.

Bitcoin Halving Countdown and Dates

Bitcoin halving dates are determined by the protocol and occur every 210,000 blocks. With the current block time of approximately 10 minutes, halving events are roughly four years apart. The Bitcoin halving chart provides a visual representation of these events over time, showing the reduction in block rewards and its impact on the Bitcoin ecosystem.

Bitcoin Halving Price and Price Prediction

One of the most closely watched aspects of Bitcoin halving is its potential impact on price. Historically, halving events have been associated with significant price rallies, as the reduced supply often leads to increased demand. However, it’s essential to approach price predictions with caution, as market dynamics are influenced by a multitude of factors beyond halving alone.

Bitcoin Halving Meaning and Implications

Beyond its immediate effects on mining rewards and price, Bitcoin halving holds broader implications for the cryptocurrency ecosystem. It underscores the decentralized nature of Bitcoin and its resistance to manipulation or inflationary pressures. Moreover, halving events serve as a reminder of Bitcoin’s deflationary model and its potential as a store of value in the long term.

Educating Yourself on Bitcoin Halving

For newcomers to the world of Bitcoin, understanding bitcoin halving and its implications is essential for making informed decisions. Resources such as the Bitcoin halving clock, historical data, and educational materials can provide valuable insights into this fundamental aspect of Bitcoin’s protocol. Whether you’re an investor, miner, or enthusiast, staying informed about halving events and their impact can help navigate the dynamic landscape of cryptocurrency.

In conclusion, Bitcoin halving is a significant event in the cryptocurrency world, with far-reaching implications for miners, investors, and the broader ecosystem. By grasping the basics of halving, its history, and its potential impact, beginners can gain a deeper understanding of Bitcoin’s unique properties and its role in shaping the future of finance.

Remember, while Bitcoin halving may spark excitement and speculation, it’s essential to approach it with a balanced perspective and a long-term view of the cryptocurrency market. Educate your self with the right knowledge before you approach any financial market. Also check for suspicious website when approaching an online opportunity during these events.

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as financial advice. Cryptocurrency investments carry inherent risks, and individuals should conduct their research and seek professional guidance before making any investment decisions.

Leave a Reply